As an investment advisory, we feel investors should have an information outlet for the financial markets that is thorough, but does not require a prerequisite degree in economics. We intend for our quarterly commentary below to be informative and educational for investors at all levels.

Quarter in Review

The dark clouds that rolled in on the stock market earlier this year proved to be a telling warning sign as storms erupted on Wall Street in August. During the 3rd Quarter 2015, the U.S. stock market turned in its worst quarter in 5 years, with the S&P 500 posting a return of -4.9%. The market also became considerably more volatile, at one point declining nearly 10% in a week. The VIX, a measure of stock market volatility that is often called the “fear gauge,” jumped more than 200% in that same one-week period.

In looking for the culprit of these declining market returns, the finger continues to point overseas, especially to China, where their equivalent to the Federal Reserve decided to cut interest rates and also devalue the currency in the same month. The takeaway of those actions was that China’s troubles might be worse than initially expected.

The U.S. Federal Reserve met in mid-September, with most economists believing this meeting would mark the end of zero-interest-rate policy. However, in a near unanimous vote, the governors and chairwoman Yellen voted against a raise in rates–citing continued weaknesses in wage growth and lack of significant inflation. The FED’s belief that low interests rates are still needed to strengthen the economy was validated by a weaker-than-expected labor department report in early October, making the timing of future rate hikes more questionable.

Outlook

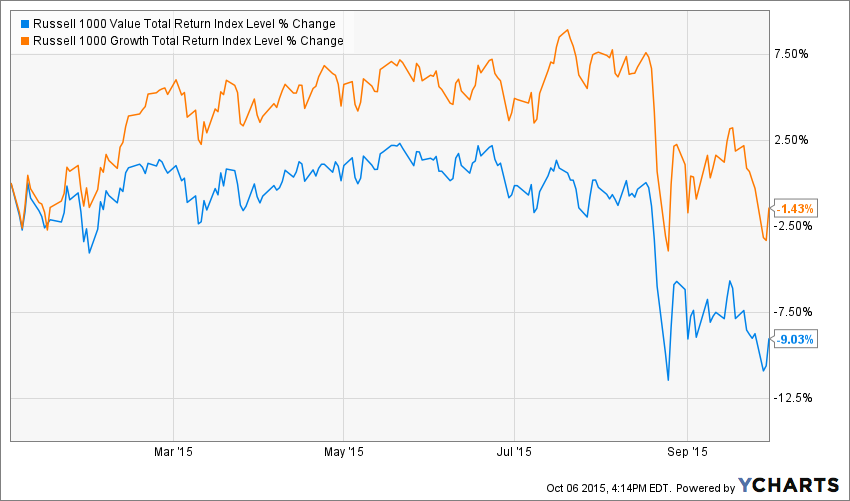

The economic conditions during the first three quarters of 2015 have been more favorable to some companies than to others. A good way to see this is to compare indexes of value stocks and growth stocks. Value stocks are priced less expensively than the average company, whereas growth stocks are more expensive because these are companies that are growing rapidly (full explanations of each are included in the glossary).

Over long periods of time, value stocks tend to outperform growth. However, growth stocks have often shown short periods of significant outperformance. This year has been one of those periods as illustrated by the chart below. The growth index has large allocations to industries like biotechnology, Internet, and retail companies, which have benefitted from low interest rates and little obligation to produce near-term profits. The value index in comparison has high allocations to sectors that sputter with low interest rates, such as banks and insurance as well as energy, which have been depressed along with low oil prices.

The growth index has large allocations to industries like biotechnology, Internet, and retail companies, which have benefitted from low interest rates and little obligation to produce near-term profits. The value index in comparison has high allocations to sectors that sputter with low interest rates, such as banks and insurance as well as energy, which have been depressed along with low oil prices.

If economic forecasting and history play any role, value is beginning to look increasingly attractive. With the Federal Reserve eyeing a rise in interest rates within the next 6 months and the supply of oil dropping, the value headwinds look to be subsiding. In addition, periods of growth leadership have historically been fleeting, followed by sharp reversals and years of underperformance as seen in the chart below. Hindsight is 20/20–if the technology boom of the late 1990’s taught investors anything, it is that irrational overpaying for stocks can last longer than is appropriate. Growth stocks may have months or even years of outsized returns, but a prudent investor can avoid surprises with a diversified portfolio of the sexy high-fliers and the steadfast yawners.

Hindsight is 20/20–if the technology boom of the late 1990’s taught investors anything, it is that irrational overpaying for stocks can last longer than is appropriate. Growth stocks may have months or even years of outsized returns, but a prudent investor can avoid surprises with a diversified portfolio of the sexy high-fliers and the steadfast yawners.

Glossary

Growth Investing – Focus on stocks that are growing sales and earnings at a higher pace than other stocks. Investors are typically willing to pay a higher price for growth stocks, leaving them susceptible to sudden drops.

Value Investing – Focus on stocks that are cheaper on a per-share amount of sales or earnings. In many instances value stocks are former growth stocks that have reached maturity without a catalyst for future growth.

IMPORTANT INFORMATION

The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes and represents Wilson Capital’s views based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Wilson Capital is a Registered Investment Advisor (“RIA”), registered in the state of Massachusetts. Wilson Capital provides asset management and related services for clients nationally. Wilson Capital will file and maintain all applicable licenses as required by the state securities boards and/or the Securities and Exchange Commission (“SEC”), as applicable. Wilson Capital renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Click here to download the Investment Letter PDF: 3Q15-Investment-Letter-FINAL.pdf (577 downloads )