As an investment advisory firm, we feel investors should have an information outlet for the financial markets that is thorough, but does not require a prerequisite degree in economics. Thus we have included a glossary of terms at the end of this commentary. Each term with an asterisk has a corresponding definition in the glossary. We hope this makes our commentary informative and educational for all levels of investors.

Quarter in Review

During the first quarter of 2015, the S&P 500 stock index returned 1% while the Barclays Aggregate bond index returned 1.6%. The tepid returns, especially in the stock market, mask the high level of big day-to-day swings that occurred during the three months. To put it in perspective, the S&P 500 had 19 one-day swings in excess of 1% in the 1st quarter alone, compared to 38 for the entire year in 2014. These statistics reflect a market where investors are still finding their footing in a world of dramatically lower oil prices, lack of inflation, and stagnant corporate profits.

Perhaps the biggest economic story of the quarter involved currency, as the Swiss central bank suddenly decided to end their policy of pegging* the Swiss Franc to the Euro in mid-January. The results of this change proved that surprises are not a currency investor’s best friend, with stories of over-leveraged investors losing small fortunes splashing the financial headlines.

The quarter came to a close with some news that ketchup giant Heinz (owned by Warren Buffett’s Berkshire Hathaway) was buying Kraft Foods, marrying two kings of the packaged foods industry and adding 36% to Kraft’s stock price on the day of the announcement. Despite widespread studies showing Americans are increasingly shunning packaged and preservative-packed foods, perhaps the best investment advice is to pay more attention to what Warren Buffett is eating.

Outlook

Share Buy-Backs

According to a recent Wall Street Journal report, in 2014, 22 companies in the S&P 500 showed earnings-per-share (EPS) growth solely due to share repurchases. If you tuned out reading that last sentence I don’t blame you, as it sounds like a typical financial report headline heard on the nightly news. However, when we dig into this story, the content plays a significant role in what is happening in today’s economy.

Let’s break it down.

Every three months, companies release data announcing how the company performed in the prior quarter. Earnings-per-share is perhaps the most important number that companies release. Since companies are all different sizes and stock prices are for the most part random, the EPS number provides a standardized indicator of how much each company made in profits. However, unlike a gross number, EPS is an equation with earnings in the numerator and shares outstanding in the denominator. The company’s earnings are hard to fudge (unless that company is Enron), but the ‘shares outstanding’ number in the denominator can be manipulated by each company. As companies make money, they have several options for how to use that money. Some pay dividends, some reinvest in their company, and some choose a third option, which is buying back some of the company’s shares. Since investors place so much emphasis on meeting or beating EPS expectations, a lower share count can help that cause.

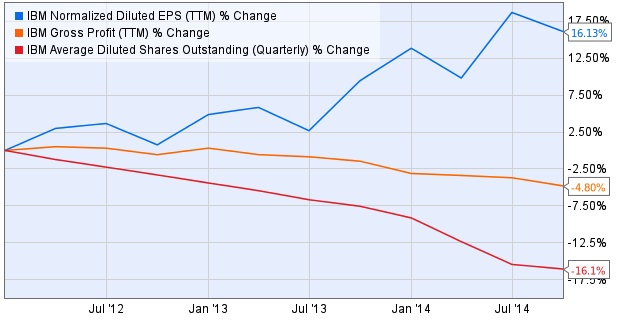

An example in action is below, with IBM’s recent move to aggressively buy back shares during the backdrop of decreasing profits. As you can see, IBM’s EPS (the blue line) has grown in recent years because the percentage reduction in profits (the orange line) has been smaller than the percentage reduction in the number of shares outstanding (the red line).

While this action may help boost the paper gains* in investors portfolios (especially company executives) it does very little for the broad economy. A dollar spent on either capital expenditures for the company or dividends to investors offers a chance for that dollar to trickle through the economy and increase the wealth of all those who play a part.

Without a major increase in inflation rate or incentives for companies to expand their business, the era of the buy back may be something that is here to stay for some time. While this trend may make companies and investors feel warm and fuzzy on strong performance, buy backs offer little more than a facade to their underlying results.

Glossary

Currency Pegging – Setting a fixed exchange rate of one country’s currency to another. Often used in countries that trade extensively in a particular country. An example includes the pegging of the Chinese Yuan to the US Dollar until 2005.

Paper Gain – Refers a gain from an investment that is still held. Paper gains show up on your statement, but haven’t been pocketed yet.

IMPORTANT INFORMATION

The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes and represents Wilson Capital’s views based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Wilson Capital is a Registered Investment Advisor (“RIA”), registered in the state of Massachusetts. Wilson Capital provides asset management and related services for clients nationally. Wilson Capital will file and maintain all applicable licenses as required by the state securities boards and/or the Securities and Exchange Commission (“SEC”), as applicable. Wilson Capital renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Click below to download a PDF of the complete Investment Letter:

Wilson-Capital-1Q-2015-Investment-Letter1.pdf (629 downloads )